How to Choose a Car Finance Plan That Fits Your Needs

How to Choose a Car Finance Plan That Fits Your Needs

Blog Article

Top Tips for Securing the most effective Car Financing Bargains

Browsing the landscape of cars and truck financing can be a complicated endeavor, yet comprehending key methods can considerably enhance your chances of safeguarding positive terms. Establishing a clear budget plan is essential, as it guarantees that your total vehicle expenses remain convenient within your month-to-month revenue. Additionally, discovering numerous financing alternatives and comparing rates of interest can discover opportunities that line up with your financial goals. There are important steps that typically go neglected, which might make a considerable distinction in your overall economic commitment. What might these actions entail, and just how can they be efficiently implemented?

Understand Your Budget

Before getting started on the journey of auto funding, it is necessary to realize the financial criteria that define your budget. Developing a clear budget plan is the keystone of making notified decisions throughout the funding procedure. Begin by analyzing your monthly earnings and identifying your vital costs, such as rent, energies, and grocery stores. This will aid you establish exactly how much disposable revenue is available for a car payment.

Next, consider the overall cost of ownership, that includes not simply the month-to-month settlement yet additionally insurance, upkeep, gas, and tax obligations. A common guideline is that your vehicle costs need to not surpass 15% of your month-to-month take-home income. Additionally, assess your present debt-to-income ratio, as lending institutions usually utilize this metric to examine your credit reliability.

Factor in any type of potential adjustments to your monetary circumstance, such as task stability or upcoming costs, to guarantee your spending plan remains sustainable throughout the funding term. This extensive understanding will certainly equip you to make audio financial decisions in your vehicle financing journey.

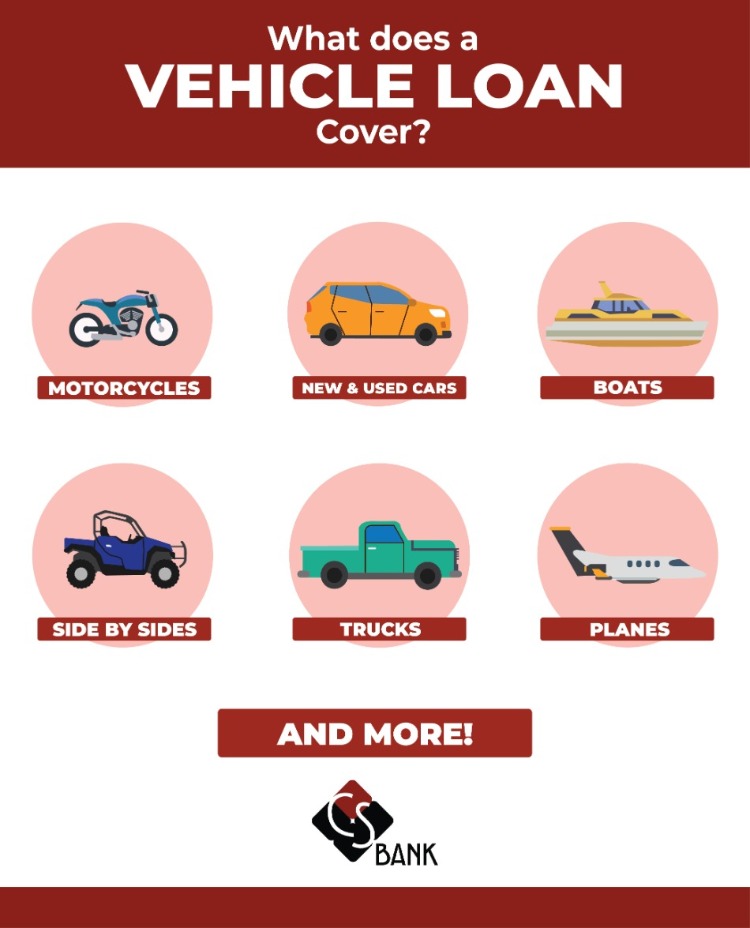

Study Funding Options

.jpg)

When thinking about conventional financial institutions or credit rating unions, review their rate of interest and financing terms. Frequently, lending institution supply competitive prices because of their non-profit status, potentially saving you money over the life of the car loan. Car dealership financing may offer convenience, yet it's vital to compare their rates against those supplied by outside lending institutions to ensure you are getting a fair offer.

Online loan providers have become practical alternatives, typically providing affordable prices and quick authorizations. Make use of online comparison devices to assess multiple deals concurrently, ensuring you have a thorough understanding of the marketplace.

Furthermore, think about the influence of lending terms on your budget. Shorter lending terms may cause greater month-to-month settlements yet reduced overall interest expenses, whereas longer terms could ease month-to-month capital at the expenditure of complete passion paid. Make notified decisions based on your economic scenario and long-term goals.

Inspect Your Debt Rating

Recognizing your credit rating is an essential facet of the auto funding process, as it directly affects the rate of interest and terms you might get. Lenders utilize your credit report to examine the threat related to loaning you money, and a greater score usually causes much more beneficial funding options.

To begin, obtain your credit report from among the significant credit rating bureaus. Evaluation it completely for any type of errors or disparities that can negatively impact your score. If you find mistakes, call the bureau to remedy them quickly.

Furthermore, prevent handling brand-new debt or making significant purchases prior to requesting vehicle finance, as these actions can decrease your credit rating. By proactively managing your credit rating, you can place on your own for much better funding bargains, ultimately saving you cash in the lengthy run.

Negotiate Terms and Prices

Negotiating rates and terms is a vital step in protecting beneficial automobile funding choices. Begin by investigating current market prices for automobile loans, which will give you a strong home standard throughout negotiations.

When reviewing terms, emphasis on both the rates of interest and the financing period. A lower rate of interest can considerably decrease the complete cost of the car loan, while a shorter term might result in greater month-to-month settlements however reduced total rate of interest. Think about presenting completing deals from other loan providers to reinforce your negotiating setting.

In addition, be prepared to talk about the deposit - Car Finance. A larger deposit can lower the funding amount and might cause a lot more favorable terms. Keep in mind to ask about any kind of costs or fees that may be consisted of in the funding contract, as these can influence the overall cost

Ultimately, effective negotiation entails being educated, positive, and going to explore options till you secure the most advantageous funding terms for your automobile purchase.

Review the Small Print

When it pertains to auto financing, taking note of the small print can save you from costly surprises later on. Lenders frequently consist of crucial details in the terms and conditions that might substantially impact your total monetary commitment. These details can incorporate rates of interest, payment periods, and any type of affiliated charges.

First of all, scrutinize the Interest rate (APR) A deceptively low introductory rate might change to a higher rate after a given period, raising your monthly repayments. In addition, bear in mind of early repayment charges, which can enforce fees for paying off your loan early, limiting your economic adaptability.

Moreover, recognize hidden costs such as documents costs, processing fees, or insurance coverage needs that can pump up the complete expense of your loan. Comprehending these aspects is vital in evaluating real price of your automobile financing agreement.

Last but not least, consider the terms bordering the vehicle's warranty and upkeep dedications, as these can influence your lasting expenditures. Car Finance. important source By carefully reading the fine print, you encourage on your own to make informed decisions and secure the most effective possible financing offer without unanticipated economic burdens

Final Thought

Thorough study right into funding options permits for notified contrasts of rate of interest rates from numerous establishments. A strong credit history rating significantly boosts possible funding terms. By sticking to these principles, people can attain positive funding results for their automobile purchases.

Prior to embarking on the trip of cars and truck funding, it is vital to realize the financial criteria that define your budget plan.Checking out funding choices is a crucial step in protecting the best possible terms for your automobile acquisition.Working out terms and prices is a crucial action in securing desirable cars and truck financing choices.When it comes to car financing, paying attention to the great print can save you from pricey shocks down the roadway. basics A strong credit history rating significantly boosts potential funding terms.

Report this page